Yield farming has become one of the most popular ways for crypto investors to earn rewards through decentralized finance (DeFi). By providing liquidity or locking up tokens, investors can generate additional income. However, these earnings come with tax obligations in the United States.

The IRS has not issued yield-farming-specific guidance, but existing rules for digital assets still apply. Depending on the type of transaction, yield farming can trigger income tax and capital gains tax.

This article explains how yield farming is taxed in the US and how to stay compliant with IRS reporting rules. For a broader overview of US crypto taxation, see our comprehensive US crypto tax guide.

KEY TAKEAWAYS about Yield Farming Taxes in the US

- Yield farming rewards are generally taxed as ordinary income at the time you receive them.

- Selling, swapping, or spending those rewards later may trigger capital gains tax.

- Simply moving crypto between wallets is not a taxable event.

- The IRS requires all taxable yield farming activity to be reported on your tax return.

What is Yield Farming?

Yield farming is a decentralized finance (DeFi) strategy where you lend, stake, or provide liquidity to earn rewards. In return for supplying your crypto to a protocol, you may receive interest, governance tokens, or a share of transaction fees.

Unlike traditional savings accounts where banks pay interest, yield farming uses smart contracts on blockchain networks. This makes it possible to earn higher returns, but it also carries more risks, such as smart contract bugs or token price volatility.

Yield Farming Taxes in the US: Income, Gains & Reporting Rules

The IRS has not issued tax rules specific to yield farming. Instead, it applies the same framework used for other crypto activities such as staking, mining, and trading. This means yield farming can trigger income tax or capital gains tax, depending on the situation.

Income Tax Treatment

When you receive tokens from yield farming, they are taxed as ordinary income at the fair market value in USD on the day you receive them. These amounts are added to your annual income and taxed at your marginal income tax rate (10% to 37% for 2025).

Example: Yield Farming Rewards as Income

Explanation: On 20 April, you receive 50 UNI tokens worth $500. You must report $500 as ordinary income for that year. This is taxed according to your personal income tax bracket.

Capital Gains Treatment

When you dispose of the reward tokens, you trigger capital gains tax. Your cost basis is the value at receipt. The gain or loss is the difference between this cost basis and the disposal value. Capital gains can be:

- Short-term: If held for less than a year, taxed at ordinary income rates (10%-37%).

- Long-term: If held for more than one year, taxed at preferential long-term rates (0%, 15%, or 20%).

Example: Selling Yield Farming Rewards

Explanation: You first report $500 as income in April. When selling in June, you realize a $200 short-term capital gain, taxed at your ordinary income bracket.

For a full list of income tax thresholds and more examples of capital gains taxation, see our dedicated guide on Crypto Earnings Taxation in the US.

All Crypto Investments at a Glance

Taxable vs. Non-Taxable Events

Not every yield farming action creates a taxable event. Some activities are clearly taxable, while others remain in a gray area because the IRS has not yet issued DeFi-specific guidance. Understanding the difference helps avoid both underreporting and overpaying taxes. Common taxable events include:

- Selling tokens for fiat

- Swapping tokens for other crypto

- Using tokens to pay for goods or services

- Receiving interest and rewards

When it comes to Deposits and Withdrawals from Liquidity Pools, the tax treatment remains uncertain, as the IRS has not issued DeFi-specific rules. Two main approaches are observed in practice:

- Conservative interpretation: Depositing into a pool is treated as swapping your tokens for LP tokens, creating a taxable disposal. Similarly, withdrawing is seen as swapping LP tokens back into the underlying assets, which can again trigger a capital gain or loss.

- Alternative interpretation: Depositing and withdrawing are treated as non-taxable transfers, with LP tokens seen as a kind of “receipt” for your deposit. In this view, you are only taxed when you finally sell/dispose of your original assets.

Because IRS guidance on DeFi is limited, tax treatment of deposits and withdrawals can vary and depend on the individual case. To avoid mistakes, consider professional help. With the CoinTracking Full-Service, crypto tax experts review your yield farming activity and ensure the correct reporting approach is applied.

Yield Farming vs. Liquidity Mining: Key Differences

Yield farming and liquidity mining are often used interchangeably, but they are not exactly the same:

- Yield farming: This is essentially the umbrella for most DeFi activities that generate a return (lending, providing liquidity, using yield aggregators, restaking, etc.). When people say “I’m yield farming,” they usually mean they are locking or deploying crypto into a protocol to earn yield in some form.

- Liquidity mining: This is a subset of yield farming. It specifically refers to providing liquidity to a pool (e.g. on Uniswap) and receiving additional incentives (often governance tokens) on top of trading fees.

- Staking: Some people include staking under yield farming, while others treat it separately. It depends on context. Technically, staking is different because it’s about network security rather than lending/liquidity provision. Still, in everyday DeFi usage, staking rewards are often lumped into “yield farming” since they generate passive returns.

Tax Perspective on Yield Farming and Liquidity Mining

From a tax point of view, the rules are consistent across yield farming, liquidity mining, and staking. In all cases, the rewards you receive are taxed as ordinary income at their fair market value in USD at the time of receipt.

Later, if you sell, swap, or spend those rewards, you may realize a capital gain or loss depending on the change in value since you first received them. See the example in the Capital Gains Treatment section.

Example Use Cases and Comparison of DeFi Activities

Yield Farming Risks: What You Should Know Before You Farm

Yield farming can offer high returns, but it also comes with risks that are very different from traditional investing. Understanding these risks is essential before you commit funds.

1. Smart Contract Risks

Most yield farming happens through smart contracts on DeFi platforms. If the code contains bugs or vulnerabilities, funds can be stolen or lost. Unlike banks, there is usually no insurance or recovery option.

2. Impermanent Loss

When you provide liquidity to a pool, price fluctuations of the tokens can lead to impermanent loss. This means you might end up with fewer assets in dollar terms compared to simply holding the tokens.

3. Token Price Volatility

The rewards you earn are often in governance or platform tokens. If these tokens lose value quickly, your rewards may be worth far less than expected by the time you sell.

4. Regulatory Uncertainty

The IRS and regulators have not yet provided clear rules for every type of DeFi activity. Tax treatment of deposits, withdrawals, or certain rewards could change in the future.

5. Platform Risks

Unlike centralized platforms, DeFi protocols are not regulated in the same way. If the platform shuts down or is hacked, you may lose your funds entirely.

6. Fraudulent Projects (Rug Pulls)

DeFi is still an unregulated space, and some yield farming projects may turn out to be fraudulent projects, also known as rug pulls. In such cases, project teams can disappear with investor funds, leaving participants with total losses.

How to Legally Reduce Yield Farming Taxes in the US

While you cannot avoid taxes on yield farming rewards, you can use legal strategies to reduce your tax bill. These strategies follow IRS rules and apply to all crypto activities.

Optimize Holding Periods

If you hold tokens you earned from yield farming for more than one year before selling, they qualify for long-term capital gains rates (0%, 15%, or 20%). Selling earlier means short-term gains, which are taxed at your ordinary income rate (10% to 37%).

Offset Gains with Losses

You can use losses from other crypto trades to reduce your taxable yield farming gains. This is known as tax loss harvesting. Losses first offset gains of the same type (short-term vs. short-term, long-term vs. long-term). Up to $3,000 of net losses can also reduce ordinary income, with the rest carried forward. For more information see our article on How to Report Crypto Losses & Reduce Your Crypto Taxes.

Make Use of Allowances and Deductions

Every taxpayer in the US benefits from allowances such as the standard deduction ($15,000 for single filers and $30,000 for married filing jointly in 2025). These reduce your overall taxable income, which means you may pay less tax on your yield farming rewards and gains. Additional deductions or credits (such as charitable donations or retirement contributions) can also help lower your total tax burden.

Track Your DeFi Activity

Yield farming generates many small transactions, which can be hard to track manually. Using software like CoinTracking ensures all your wallet and protocol activity is automatically imported, so nothing is missed. This is especially important since the IRS requires accurate cost basis and disposal values.

Harvest Strategically

You can plan when to claim or sell yield farming rewards. For example, delaying disposal until the next tax year may lower your taxable income if your bracket will be lower. On the other hand, realizing losses before year-end can reduce your current year’s tax bill.

Creating a Crypto Tax Return Made Easy

How to Report Yield Farming Income & Gains to the IRS

Reporting yield farming activity follows the same process as reporting other crypto income and gains. Depending on the type of transaction, you will use:

- Form 1040: The main tax return where all totals are consolidated.

- Form 8949: Used to report crypto disposals.

- Schedule D: Summarizes total capital gains and losses.

- Schedule 1 or Schedule C: Used to report crypto income, depending on how it was earned.

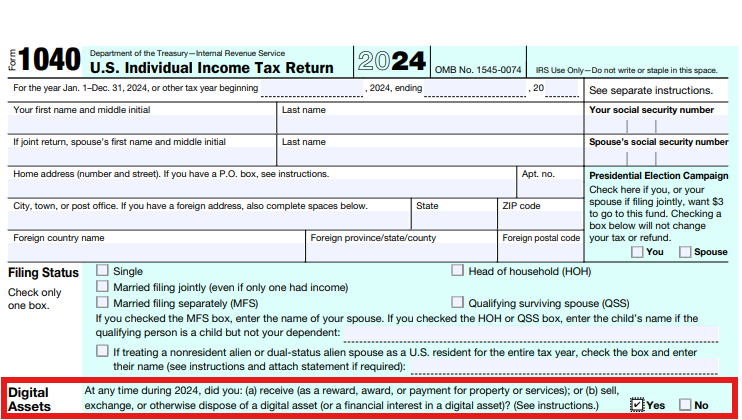

Form 1040: Answering the IRS Crypto Question

On the front page of Form 1040, all taxpayers must answer the digital assets question. You must answer Yes if you disposed of or earned crypto during the year. Simply buying and holding or transferring between your own wallets does not require a “Yes.” For detailed instructions, see the official IRS Form 1040 Instructions.

After completing Form 8949, Schedule D, and Schedule 1/C, the totals are carried over to Form 1040, your main tax return form.

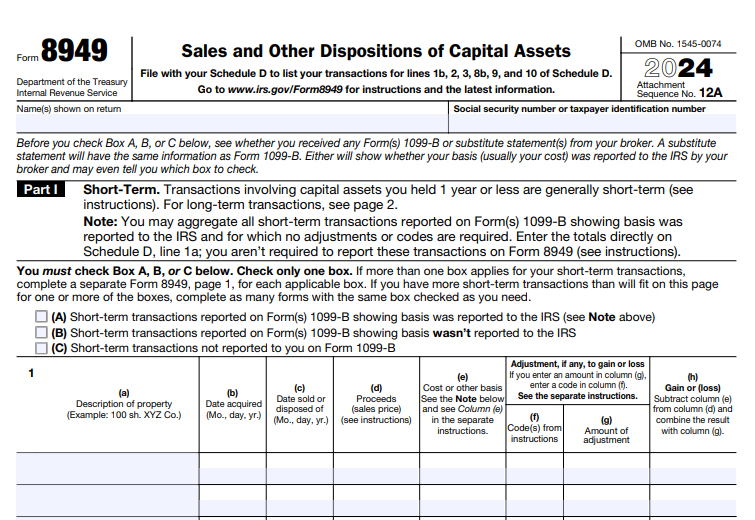

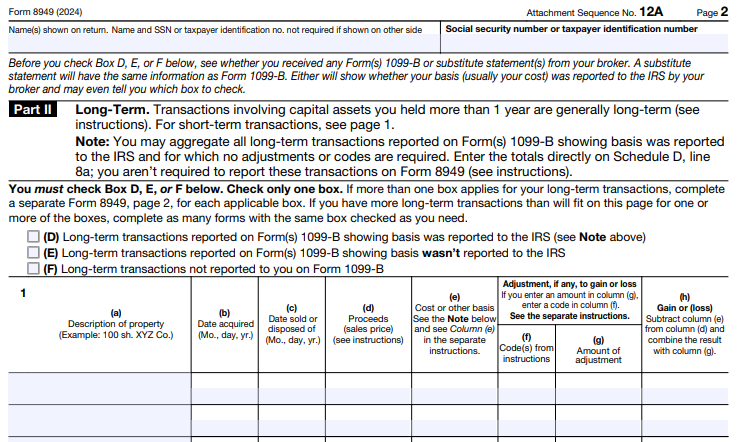

Form 8949 + Schedule D: Reporting Crypto Disposals

Every crypto disposal must be reported on Form 8949. The form is divided into:

- Part I (Short-Term) – For crypto held 1 year or less before disposal.

- Part II (Long-Term) – For crypto held more than 1 year before disposal.

For detailed instructions, see the official IRS Form 8949 Instructions.

Totals from Form 8949 are carried over to Schedule D (Form 1040), which summarizes:

- Net short-term gains or losses (from Part I)

- Net long-term gains or losses (from Part II)

- Overall net capital gain or loss for the year

For detailed instructions, see the official IRS Schedule D Instructions.

Schedule 1 & Schedule C: Reporting Yield Farming Income

Crypto received as earnings must be declared as ordinary income:

- Schedule 1 – if the income is not from running a business.

- Schedule C – if the income is part of business or self-employment.

For detailed instructions, see the official IRS Schedule 1 Instructions and the IRS Schedule C Instructions.

Yield Farming Taxes in Other Countries

Yield Farming Taxes in Canada

Yield farming rewards are taxed as income when received. Later disposals may trigger capital gains tax. See our full Crypto Tax Guide for Canada.

Yield Farming Taxes in Australia

The Australian Tax Office (ATO) treats yield farming rewards as ordinary income at market value when received. Later disposals are taxed under capital gains tax (CGT) rules. See our full Crypto Tax Guide for Australia.

Yield Farming Taxes in the UK

HMRC generally taxes yield farming rewards as income when received. When rewards or liquidity pool tokens are sold or swapped, this creates a capital gains event. See our full Crypto Tax Guide for the UK.

Conclusion - How is Yield Farming Taxed in the US?

Yield farming can be a profitable DeFi strategy, but it comes with clear tax obligations. Rewards are taxed as ordinary income when received, and any later sales or swaps are subject to capital gains tax. The IRS requires these transactions to be reported accurately, just like other forms of crypto income.

Keeping detailed records of your DeFi activity is essential to stay compliant. CoinTracking makes this easier by importing your transactions, calculating income and gains, and generating IRS-ready reports such as Form 8949 and Schedule D.

Disclaimer

The information provided in this article is for educational and informational purposes only. It is not intended as financial, investment, tax, or legal advice. Cryptocurrency investments are highly volatile and carry significant risks. Before investing in cryptocurrencies, conduct thorough research, consult with a financial advisor, and ensure you understand the risks involved. The author and publisher are not responsible for any financial losses or damages that may occur from following the information presented in this article. Always use caution and make informed decisions when dealing with cryptocurrencies.