TurboTax is one of the best and easiest ways to file your crypto tax in the US or Canada, its integration with the crypto tax softwares makes this process very easy for you.Let’s explore what TurboTax is, how it supports crypto, how to file crypto taxes with TurboTax, its integration with CoinTracking and much more!

KEY TAKEAWAYS ABOUT CRYPTO TAXES WITH TURBOTAX

- TurboTax is one of the most sought-after tax preparation software in the US;

- TurboTax enables investors to import their crypto trades & file their crypto taxes;

- The best way to use TurboTax is to connect it with a crypto tax software that offers more options to import transactions and generate tax reports;

- CoinTracking has a seamless integration with TurboTax to file crypto taxes in a few clicks.

What is TurboTax?

TurboTax is the most popular tax preparation and filing software in the US and Canada, developed by Intuit, enabling millions of taxpayers to fulfill their obligations.

Does TurboTax do Crypto?

TurboTax supports cryptocurrency tracking and the generation of tax forms, besides the ability for investors to file their crypto tax forms to the IRS in the US. However, TurboTax is not a fully-fledged crypto tax software, supporting only a few exchanges and limited types of transactions.

Which Crypto does TurboTax Support?

TurboTax supports cryptocurrencies but in a limited fashion. Here’s the full list of supported platforms and assets:

TurboTax Supported Exchanges

TurboTax supports 15 of the most popular crypto exchanges on its platform. Here’s the list:

- Coinbase

- Gemini

- Bitstamp

- Kraken

- Crypto.com

- Celsius

- BlockFi

- Voyager

- KuCoin

- Gate.io

- Binance.US

- Bittrex

TurboTax also offers the option to import crypto from other trading avenues (e.g., stocks) like eToro, Fidelity Investments, TD Ameritrade, Robinhood, Charles Schwab, and Morgan Stanley. However, if you trade on these platforms, it will be more difficult to track your operations, given the limits on supported transactions. As a result, crypto investors should use native portfolio trackers and crypto tax tools.

TurboTax Supported Wallets

TurboTax supports some of the most popular crypto wallets on its platform for investors to track trades, including:

- Exodus

- MetaMask

- Coinbase

- Trust Wallet

Please note that TurboTax only enables the importing of certain coins – those it supports overall – within the automatic imports from these wallets. Moreover, TurboTax does not accept many wallets, including hardware wallets (e.g., Ledger and Trezor) or wallets focused on other chains like Solflare (e.g., Solana).

TurboTax Supported Cryptocurrencies

TurboTax supports only the most popular cryptocurrencies, offering a small range of options for investors. Currently, you can import the following coins, besides Bitcoin (BTC) and Ethereum (ETH):

- Bitcoin Cash (BCH)

- Dogecoin (DOGE)

- Litecoin (LTC)

- Polkadot (DOT)

- Ripple (XRP)

- Solana (SOL)

- Tezos (XTZ)

Given the limited options and workarounds needed to import trades through CSVs, the best option for investors is to use crypto tax software to track trades using blockchain addresses.

TurboTax Supported NFTs

TurboTax enables NFT reporting, but you may need to manually identify these transactions after importing blockchain data (for specific coins). For example, after importing Ethereum-based NFTs with your address, you would need to follow these manual steps:

- Add the date and time of the transaction.

- Add the transaction type and source of the NFT.

- Select “This is an NFT.”

Check the full steps in the TurboTax NFT Guide.

Report Crypto Income from Staking, Mining, and Airdrops in TurboTax

TurboTax does not recognize tracking of crypto income from activities like crypto mining, staking, airdrops, hard forks, salaries, earning interest, etc. The automatic imports do not track income from these sources, so you would need to do it manually, which is quite challenging. To report crypto income, use software that determines the Fair Market Value at the time you receive new coins from these activities.

Get Set Up on TurboTax & CoinTracking

Here’s how to get set up with TurboTax and CoinTracking:

On CoinTracking

You can use CoinTracking to calculate your crypto gains/losses and generate tax reports into TurboTax to file your crypto taxes. Here’s how to calculate your crypto gains with CoinTracking and download your data for TurboTax:

- Import your crypto trades from 100+ exchanges into CoinTracking;

- We calculate your crypto gains/losses according to your desired accounting method (from 13 available);

- Generate a report for that tax season;

- Click on “Load Report” and then select TurboTax from the options;

- If you have less than 2251 transactions (TurboTax limit), click on “Download your capital gains data” to download the file for TurboTax;

- If you have more than 2251 transactions, download the “capital gains data summarized”.

On TurboTax

You can download your capital gains data from CoinTracking and import it on TurboTax to file your crypto taxes. Here’s how:

- Download the capital gains file and log into your TurboTax account;

- Select “Federal” in the left navigation bar and “Stocks, Cryptocurrency, Mutual Funds, Bonds, Other” at the right;

- Select “YES” on the page “Did you sell any of these investments in Year?”;

- Select “Cryptocurrency” and “Continue;”

- Select “Try another way;”

- Select “Upload it from my computer” and “Continue;”

- Select “Other” under Crypto service, add CoinTracking as “Name” and “Continue;”

- Upload your CSV file.

The Best Crypto Tax Calculator!

How to Report Crypto in TurboTax

Check out our step-by-step guide on how to report your crypto capital gains or crypto income with Turbo Tax.

How to Report Crypto Capital Gains in TurboTax

1. Go to the right side menu, under “Federal,” and open the “Wages & Under income” tab

2. Select Investments and Savings (1099-B, 1099-INT, 1099-DIV, 1099-K, Crypto)

3. Import your crypto transactions from the available options or select “enter a different way”

4. Now, select “Cryptocurrency”

5. Select “upload it from my computer”

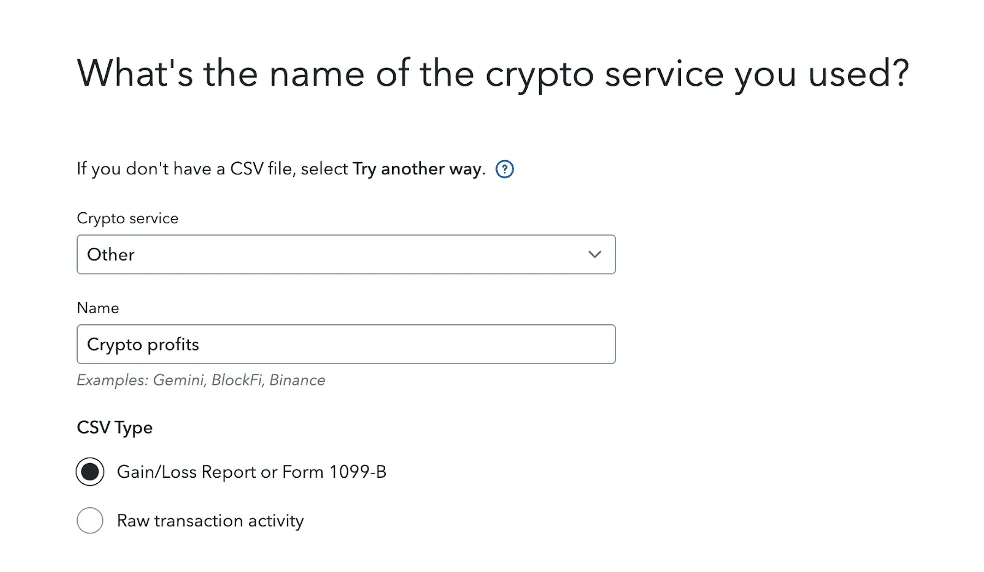

6. Select “Other” from the drop-down menu asking “what’s the name of the crypto service you used?”

7. Assign a name to the file and select “Gain/Loss Report or Form 1099-B.”

8. Now you can upload your CSV file from CoinTracking into TurboTax

9. Review and continue

10. Compare the number to your total on CoinTracking and once you finish, you can continue to the tax return

How to Report Crypto Income in TurboTax

1. After logging in, go to the right side menu, under “Federal,” and open the “Wages & Under income” tab

2. For crypto income, click on the “Add more income” button

3. Click on the “Less common income” tab

4. Select “Miscellaneous Income, 1099-A, 1099-C”

5. Select “Other reportable income”

6. Answer “Yes” to the “Any other taxable income?” question

7. Under “Other Taxable Income,” give a description of the income you had and enter its amount.

8. Review the information in the miscellaneous income summary section and continue to your tax return

Can I Upload a Crypto 1099 to TurboTax?

You can upload a 1099 form into TurboTax if your broker or financial institution is on the official TurboTax Partner list. If that’s not the case, you’d need to import the forms from your computer or type them in yourself on TurboTax. The easiest way to report your crypto from several exchanges is to first use crypto tax calculator that enables you to track all of your operations, generate tax forms with the relevant information, and then import that information to TurboTax.

What’s the Best Crypto Tax Software to Use with TurboTax?

The best way to file your crypto taxes with TurboTax is to use a crypto tax tool that offers a simple integration, like CoinTracking. If you’re an investor with both trades and income from crypto activities, you should use a crypto tax software like CoinTracking that enables you to track all of those. With CoinTracking, you can also generate the tax reports needed and import them into TurboTax in a few clicks to automatically file your crypto taxes.

What if I Have More than 20,000 Transactions?

TurboTax has a transaction limit per brokerage account, and if you surpass it, they recommend using a summary of transactions. On CoinTracking, you can subscribe to the Expert or Unlimited plans and track all of your gains/losses and income for 20,000+ crypto transactions. One of those plans includes unlimited crypto transactions.

Create an Easy Crypto Tax Return

Conclusion

TurboTax is one of the most popular tax preparation software in the world, enabling investors to file their taxes, including crypto. However, if investors have more needs than tracking simple trades from the most popular exchanges, they would need to use a native crypto tax software that tracks crypto income and all types of crypto trades from exchanges, blockchains, coins, and wallets. CoinTracking seamlessly integrates with TurboTax for investors to track their crypto gains and income, generate tax reports, and file their crypto taxes.

Summary of Key Points

TL;DR about how to file crypto taxes with TurboTax:

- TurboTax supports 15 crypto exchanges, three crypto wallets, and many cryptocurrencies;

- Crypto investors can use TurboTax and crypto tax software to achieve optimal results when filing crypto taxes;

CoinTracking integrates with TurboTax to simplify the crypto tax experience of investors.